Mining is described as the process of

adding transaction records to public ledgers containing details of past transactions. It involves analyzing compound computations, identifying solutions and being compensated in Bitcoin. The amount a user receives is subject to the complexity of tasks completed and the speed at which the user’s machine processes transactions (hash rates).

Mining of the first premier cryptocurrency could not be carried out using a home computer when Bitcoin was introduced to the market in 2009. Currently, restrictions in the mining process are much higher compared to the overall profits gained. Since the tasks involved are quite arduous, miners require very

powerful machines to mine Bitcoins.

There are several steps involved in Bitcoin mining. Although the mining process may pose greater risks and mammoth monetary investments, the potential rewards are significant. However, experts warn that when it comes to buying altcoins and Bitcoin, nothing is certain.

Discussed below are the steps to follow for those interested in mining Bitcoin:

Choose your mining company

Recently, mining hardware has become exorbitantly expensive, therefore,

cloud mining is a viable alternative. This is where miners rent mining hardware and allow others to mine on their behalf. The miner is ‘paid’ for the Bitcoin investment even when the hardware is not used for the mining process.

It is important to conduct extensive research to identify the best deals. Some scammers purport to be the best option, but are out to swindle the user, certain large players also have their detractors. If a miner does not find a viable company, they can make use of the CryptoCompare platform which has an exhaustive list of reputable companies, including user ratings and reviews.

Select a Mining Package

After obtaining a cloud mining provider, it is essential to find the best mining package. This process involves selecting the optimal

cross-referencing and hashing power within the user’s budget. Additional payments generally promise a better return although this is not always guaranteed.

The majority of cloud mining companies help users choose the best package by providing calculations subject to Bitcoin’s current market value. The package considers the difficulties involved in the mining process, and is then cross-referenced with the hashing power a user wishes to hire.

The numbers change constantly, therefore, it is advisable to review market trends to determine where the Bitcoin price may be heading before selecting any contract. Some companies sell contracts on a ‘pre-sale’ basis. This strategy is not advisable since there is no guarantee that the contracts will be profitable once they commence.

Get a mining pool

After obtaining the ideal contract, most cloud mining companies require a user to

pick a pool. In this step, the user selects a global mining team to join. It is a reliable strategy for increasing the chances of earning Bitcoin through the mining process.

As a beginner, it is best to join a proven and established pool which requires low joining fees.

Select a wallet

After completing the steps mentioned above, the mining process can begin, and within days or weeks, the user can expect to see their cloud mining account begin to pile up with Bitcoin. It is always advisable to regularly withdraw the stake into

a secure wallet.

However, some cloud mining companies will allow users to reinvest their holding to receive more hashing power. They can also sell their Bitcoins or change them into other altcoins.

The profitability of mining Bitcoin depends on many factors. It is up to the user to conduct exhaustive market research to determine what works within their budget.

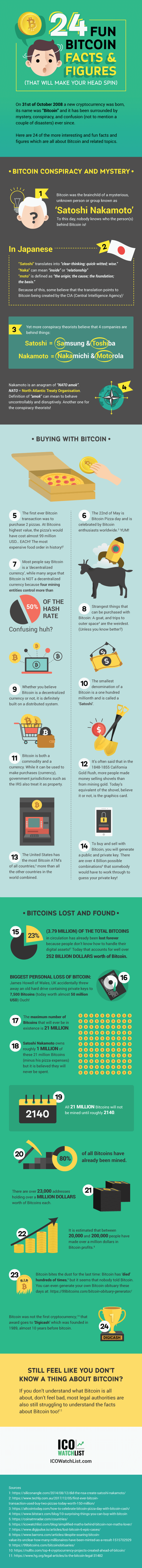

The process of mining is becoming extremely difficult since Bitcoin is finite with only 21 million coins in existence as the infographic below shows:

Infographics Originally Published

Here.