Salesforce has been one of the leading pioneers of delivering Software-as-a-Service (SaaS). The company was one of the first names in the tech industry to promote the adoption of cloud technologies and create a market for cloud solutions.

Salesforce has had an enormous impact on the world of computing. Over the past two decades, Salesforce has developed its own cloud-based customer relationship management (CRM) solutions and has emerged as the largest seller of CRM cloud solution services.

In this article, we will discuss how Salesforce is poised for further success in the future and why the growth of Salesforce in 2024 can create new opportunities for the digital transformation space.

How Did Salesforce Begin?

Before the emergence of SaaS cloud solutions, Customer Relationship Management (CRM) solutions had limited capacity and were usually deployed on-premise. The development of these in-house applications was highly complex and took months and even years in some cases.

Since the development of on-server CRM was time-consuming, the cost of these applications often peaked at millions of dollars. The massive cost attached to on-premise CRM solutions made them exclusive to large organizations and enterprises.

However, even companies who could afford these solutions found it difficult to scale these applications according to their growing needs. At the same time, it was hard to introduce new features in a given solution and requests for new features often lead to even greater costs, which organizations had to bear to acquire creative solutions.

Nevertheless, Salesforce came forward with an affordable version of the CRM software and delivered it online as a service. By leveraging increasing bandwidth capabilities, Salesforce was able to minimize the cost related to deployment and expand its cloud services to various industries. All this gave Salesforce the impetus to become the

fifth-largest software company in the world.

The Growing Market of CRM Solutions

It all begins with the hard-earned leads that enterprises gain through their marketing strategies. CRM solutions play a vital role in converting these leads to sales. According to Pardot, without the presence of a CRM solution, companies can

fail to convert as much as 79% of leads into sales.

The lack of automation in lead management makes the process inefficient. As a result, companies are not able to engage potential customers properly, making them accessible to other competitors.

On the other hand, a CRM solution enables organizations to make most of the marketing tools such as email, social media, and marketing automation. The presence of an automated CRM platform makes it easier to streamline lead management and target prospects with effective communication.

Furthermore, since companies have more time to engage with potential clients, they can develop a deeper understanding of the business requirements of their customers. Unless companies have a clear about their client’s business, it’s harder for them to sustain their relationship with them.

At the same time, adopting a CRM technology can help organizations attain a productive environment. As a result, employees and sales teams are able to perform their job more in a productive manner.

Harvard Business Review revealed that 52% of all high performing salespeople take complete advantage of their organization’s CRM technologies.

The reason behind this is the fact that adopting an automated solution frees up sales teams from time-intensive and process-heavy tasks. As a result, they have more time to perform other useful tasks, including connecting with customers.

Lastly, a CRM solution can offer automated management of customer complaints. A comprehensive system for customer redressal such as CRM provides companies greater visibility over which customers are at risk for leaving. Enterprises can transparently view customer histories, open cases, and active campaigns.

As a result, companies are able to deliver a better customer experience and improve chances for customer retention. A study by Bain and Company revealed that increasing customer retention by only

5% could improve organization profits by 25%.

According to the same report, the increase in demand for CRM applications was reinforced with the rise of enterprise applications, whose market crossed $193.6 billion by the end of 2018. Compared to the market value of $172.1 billion in 2017, the industry has experienced a growth of more than 13% in a single year.

Considering that CRM solutions were comprised of over a quarter of the total revenue from enterprise applications tell a lot about how critical they are for enterprises.

Upon further inspection, we can see that the users of CRM solutions widely preferred SaaS as the method of delivery due to its flexibility, affordability, robustness and scalability. In total spending on CRM solutions, approximately 72.9% was on SaaS-based CRM solutions. Gartner predicts that the industry is expected to grow to

75% of total CRM software spending in 2019.

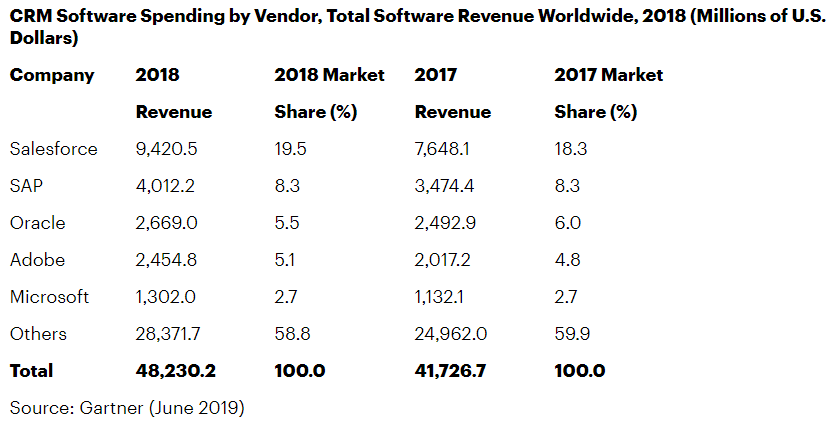

The following table shows the market share of the top five vendors of CRM solutions worldwide in 2017 and 2018.

(The table above shows that the top five CRM solution vendors claimed more than 40% of the total market share in both 2017 and 2018. [Image Source])

Interestingly, Salesforce was the leading CRM solution provider in both 2017 and 2018. However, it also had the greatest increase in global market share among the top five candidates CRM vendors in 2018.

Salesforce was able to dominate the charts by capturing almost one-fifth of the entire global market. SAP was the closest competition to Salesforce in terms of revenue gained in 2018. However, its total market revenue – $4.01 billion, was less than half of what Salesforce earned.

Similarly, other global magnates of the software solution industry such as Oracle, Adobe, and Microsoft were not able to match Salesforce’s success in CRM solutions and remained in its shadow in 2018.

With that said, the global market for CRM solutions is predicted to rise even more in the future. Due to the easy availability of cloud solutions and the option to avail cloud services at affordable prices, a growing number of businesses can invest in these solutions to optimize customer management and out-perform their competition. So there’s no surprise that Grandview Research indicated that the global CRM market is poised to

become an $81.9 billion industry by 2025.

The Secret Ingredient to Salesforce Success

The greatest driver behind the success story of Salesforce is perhaps its early advocating for cloud-based delivery of software services. When Salesforce presented the idea of cloud-based services in the early 2000s, the web ecosystem had already started to boom. However, due to the limitations on bandwidth and connection speed in that period, it took some time for their idea to gain traction.

Nevertheless, as the decade turned, Salesforce was able to make progress and from then on continued to capture the market of customer relationship management solutions. The cloud-based CRM solutions offered by Salesforce were a lot more flexible, agile, and affordable compared to traditional solutions.

With that said, Salesforce wasn’t a success story just because it offered enterprise services at a fraction of the cost. One of the main reasons behind that was that it was able to replace the lengthy installation practices by leveraging the internet.

Salesforce changed the entire business model of enterprise solution providers. Companies no longer needed to pledge themselves to long-term contracts or expensive licensing deals. Instead, they could opt for a highly scalable cloud service at a minuscule subscription fee.

Although Salesforce charged a small fee for its cloud service, it was able to break the exclusivity of CRM solutions and make them highly accessible for businesses of all sizes. Thus, Salesforce CRM’s growing popularity leads to a rapid increase in revenue.

The CRM platform allowed enterprises to save important information related to their business contacts. As a result, users of the CRM solution were able to store data related to customer information, the industries of their customers, key products, and contacts within the company.

Later, companies could use their data to perform advanced analytics and gain insights about the KPIs in their business. As a result, these users were able to gain a deeper understanding of their business and optimize their workflows for better performance.

At the same time, Salesforce expanded its operations and was able to specialize in providing additional solutions for Marketing, Sales, Support, and Analytics. The continuous quest for innovation and drive for expansion helped Salesforce gain the trust of over a thousand companies around the world.

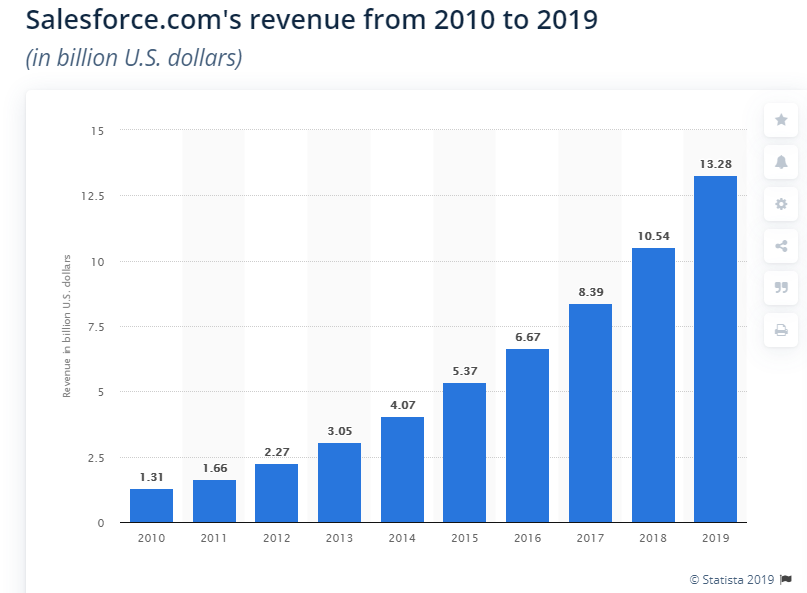

Since Salesforce cloud CRM services are highly accessible, its client base falls over a wide spectrum. Everyone from small startups to highly successful Fortune 100 companies relies on Salesforce to fulfill their functional needs. The growth of Salesforce over the years can be seen in the chart released by

Statista below:

(In the fiscal year between 2018 and 2019, Salesforce has managed to gain revenues of $2.74 billion. [Image Source])

From the table, we can see that Salesforce has been able to achieve an average annual growth of 29%, each successive year from 2010 to 2019. Starting from total revenue of $1.31 billion in 2010, Salesforce has managed to gain revenue of $11.98 billion over the course of nine years. There are many reasons why Salesforce has become a highly successful CRM solutions provider. Some of which are given below:

SaaS-Centered Solutions

Software as a Service (SaaS) is easily one of the most mature public cloud markets of this decade. The solutions show healthy growth and are increasingly becoming popular in companies of all sizes.

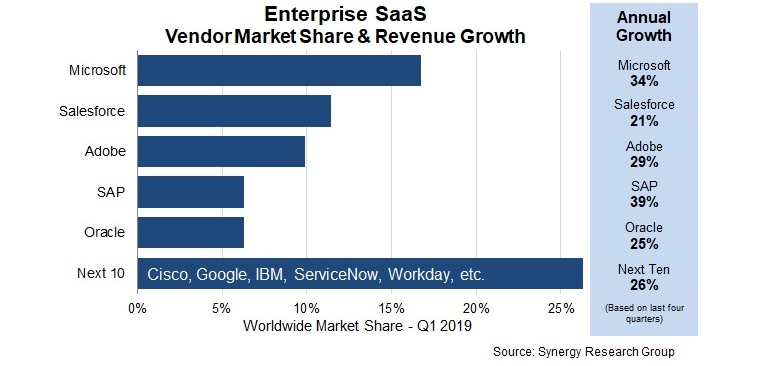

Synergy Research Group reported that software vendors that use SaaS for delivering their solutions were able to generate revenue of more than $23 billion in the first quarter of 2019.

The high adoption rates of these cloud services have caused their annual turnover rate to reach an excess of $100 billion. The study suggests that software vendors have the potential to leverage the annual growth of almost 30%. Their prediction closely correlates to the estimation presented by IDC’s

Worldwide Public Cloud Services Spending Guide. Both of these reports indicate that the SaaS market for cloud solutions will comprise of more than half of the total cloud market.

(Salesforce managed to gain 21% annual growth in Enterprise SaaS market share and revenue. [Image Source])

The infographic above shows that five vendors dominated the entire enterprise SaaS market. Most notable among these was Microsoft, which not held the highest annual revenue growth (34%) in enterprise SaaS solution but also captured the highest portion of the world market share at 17%.

Salesforce had the second-highest market share in global enterprise SaaS solutions reaching 12% of the total market. The company had decent annual revenue growth in the enterprise SaaS solution market and managed to increase its revenue by 21%.

Adobe, SAP, and Oracle, also held a considerable portion of the global enterprise SaaS solution market, earning 10%, 6%, and 6% market shares respectively. With that said, these companies managed to attain considerable after increasing their cloud-based SaaS solutions.

Adobe was able to gain an annual revenue growth of 29% and SAP earned 39%; whereas, Oracle managed to 25% more of what had the previous years. All of these five major vendors of SaaS enterprise solutions comprised 51% of the global SaaS cloud market share.

All these numbers indicate that the world is moving towards the adoption of cloud-based services in place of traditional software. Salesforce was able to envision this trend twenty years ago and was one of the companies that pioneered the SaaS cloud solutions market and built the foundation for cloud-based services.

Users of enterprise solutions quickly realized that cloud enterprise solutions gave them greater opportunities for growth. These solutions were not only highly scalable, but also easy to install, had greater acceptance for innovation, and were easily accessible.

The early adoption of cloud helped the company to attain clients of all sizes and dominate CRM-centered enterprise solutions. Salesforce was able to deliver flexible enterprise solutions with the help of SaaS cloud services.

Salesforce CRM solutions addressed the pain points of enterprise software users and gave them an alternative to traditional enterprise software. Therefore, these SaaS-centered solutions played a vital role in kickstarting Salesforce’s exceptional growth at the turn of the last decade.

360-Degree View

There has been a lot of speculation about what has caused exponential in such a short span. However, the report known as

2020 State of Salesforce provides some insights for understanding the rise of Salesforce in recent times. The study consisted of data acquired from over two thousand Salesforce customers spread across various countries of the world.

The majority of respondents made it clear that the biggest reason that they favored Salesforce was that it provided CRM users with a 360-degree view of their customers. The Salesforce platform enables users to integrate various data sources and analyze customers comprehensively.

Salesforce Acquisitions

Salesforce has been growing at an incredibly fast rate. The company has managed to expand beyond its native portfolio of CRM solutions and invested in various other ventures. In 2016 alone, the company managed to invest in and acquire 12 companies. The majority of these companies were targeted by Salesforce to boost their AI capabilities and lay the foundation for

Salesforce Einstein. In total, Salesforce has made 60 acquisitions in the past decade.

The latest one of these acquisitions was Tableau, Microsoft BI’s biggest rival in the domain of business intelligence tools. Although Salesforce has been known for making acquisitions across a diverse range, the Tableau acquisition worth $15.7 billion raised the most eyebrows.

The reason behind this is that the Salesforce Einstein service already offered significant analytical capabilities and was a competitor to Tableau to some extent. With that said, Salesforce explicitly stated that “Einstein and Tableau together”.

Therefore, we can only speculate whether these services will complement or overshadow each other in the future. Regardless, the new acquisition opened new doors for Salesforce and can help the company usher a new era of intelligent enterprise solutions.

Similarly, the second-biggest acquisition made by Salesforce was for Mulesoft in 2018. The value of this acquisition was $6.5 billion and helped the company acquire one of the largest integration platforms in the software market.

One of the biggest problems for Salesforce users was that Salesforce was exclusive to its own platform. As a result, the integration of these applications with existing systems was always difficult. However, after the acquisition of Mulesoft, Salesforce was able to leverage the platform’s ability to build application networks with APIs.

The purchase of Salesforce’s largest acquisition till that date and marked a new direction for Salesforce. Since most enterprises are based on legacy-based systems, it is difficult for them to adapt to cloud solutions. These old on-premise systems needed intervention from integration modules to connect to Salesforce or implement SaaS-based products.

In many of these organizations, migrating is a lot riskier and costly compared to sticking to legacy systems and integrating them with cloud solutions. However, after the acquisition of Mulesoft, Salesforce was able to provide middleware for integration with the help of APIs.

The service later expanded to IPaaS (Integration Platform as a Service). As a result, Salesforce succeeded in eliminating all barriers that could stop enterprise customers from adopting Salesforce.

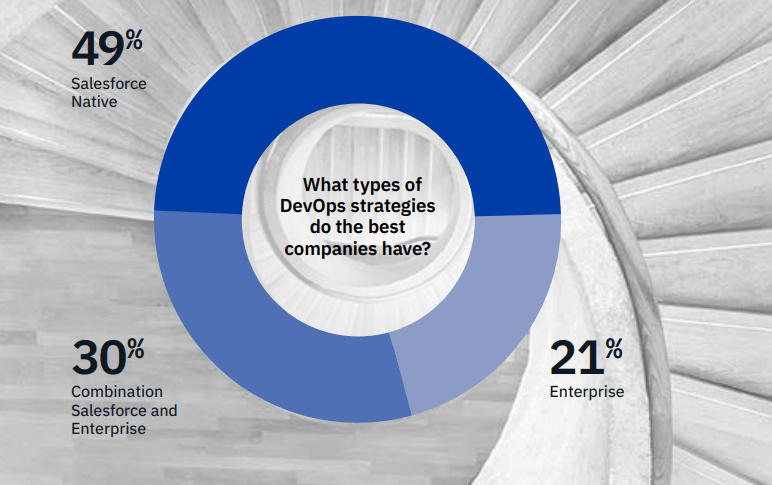

(The composition of DevOps strategies in Salesforce customers indicates that almost half of the customers forego Native Salesforce DevOps. [Image Source])

Although the acquisition of Mulesoft was regarded as doubtful in the past, it has increased the company’s ability to attract new customers. Today, Mulesoft had transformed to become an Integration Cloud, which Salesforce users can leverage for mapping and managing systems and have a complete view of devices, data, and apps.

The study conducted in

2020 State of Salesforce found that the adoption of Salesforce increased after the acquisition of Mulesoft. Furthermore, the survey even found that 16% of the respondents had already started using MuleSoft, whereas 54% of these respondents were planning to use Mulesoft in 2020.

Salesforce has been proactive in addressing all pain points of their customers. They have made continuous strides towards innovation and focused on a vision for expansion to diversify their portfolio. As a result, they were able to create a favorable environment where their solutions could thrive. All acquisitions made by Salesforce have to lead to greater acceptance of their solutions and played a considerable role in their success story.

The Rise of Low Code Applications in Enterprises

A low-code development platform is software that gives users the GUI for programming. These platforms simplify the customization of applications and reduce programming efforts. As a result, companies are able to deploy and set up environments for other applications with considerably low effort.

Therefore, there is no surprise that many enterprises are starting to adopt LCAP at an unprecedented rate. Gartner predicts that low-code application development will have a central role in developing software applications and could be responsible for more than

65% software development activity by 2024.

This idea was supported by

a study conducted by Salesforce itself. The study found that the low-code application would achieve an outstanding growth rate of 165% in the coming two years since IT organizations are increasingly demanding for low-code and no-code tools.

With that said, it’s difficult to tell why enterprises are adopting to LCAP to program the next generation of enterprise applications. One of the main reasons for this might be the increasing demand for better user experience from enterprise users.

However, this demand is not without good reason. The report further discovered that 72% of IT leaders complain that project backlogs stop them from working on strategic projects. If the IT departments of enterprise users are able to utilize LCAP environments, they have more time to increase their business agility, deliver high-value work and invest more time in providing optimal user experience to their customers.

Although Salesforce is better known for its premier CRM application services, it also has a considerable share in the LCAP market. The company’s Lightning Platform is responsible for focusing on customer-related software and extensions to SaaS. These services are supported by more than 5,000 third-party applications built and deployed on the Trailhead education service along with the Salesforce AppExchange.

Salesforce also leverages Heroku offering for high-control services. Usually, Salesforce operates mostly on its own data centers for SaaS, but recently it has begun using the AWS infrastructure to expand its cloud services.

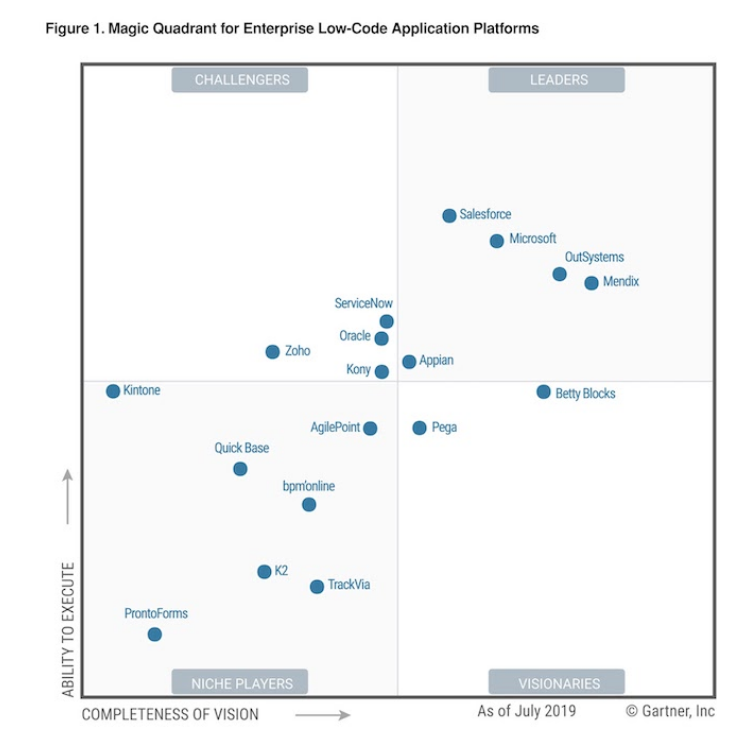

In recent years, Salesforce has invested a lot of effort and resources in providing its customers with Low Code Application Platforms. Therefore, it should come as no surprise that Gartner named Salesforce a Leader in their Magic Quadrant for LCAP.

(Gartner rated Salesforce highest in the ability to execute Enterprise Low Code application Platforms. [Image Source])

The availability of LCAP attracts a considerable portion of CRM customers related to the IT field. Salesforce is able to leverage LCAP environments to acquire greater acceptance in IT departments of their customers. By giving their customers LCAP solutions, they are able to deliver better value to users who want flexible enterprise solutions.

Salesforce’s investment in LCAP solutions is a testament to how much the company cares for the pain points of its customers. The effort Salesforce puts in identifying and addressing the requirements of its customers has helped the company pave its way to success.

Improving the Standard for Modern Enterprise Solutions

Improving customer experiences is the key to making enterprise apps that sell. Nowadays, both customers and their employees expect enterprise applications to be automated, omni-channeled, and smart. Salesforce has been able to deliver all these things by offering the

Lighting Platform to its customers.

Enterprise apps that offer only channel-specific insights to customers or their employees are no longer in demand. Users now expect enterprise apps to solve highly complex issues within a few steps.

For instance, users of mobile banking no longer demand an application that tells them their account balance, but also want tools to report fraud within the same application. The Lightning Flow platform deployed by Salesforce enables customers to develop apps that depend on specific processes surrounding its users. However, the application also has to embed automated processes every time a user interacts with the application.

Furthermore, these automated processes should also offer a contextual and personalized experience to its users. Therefore, it’s important for

app developers to make applications that adapt to the past behavior of the users and present with them the best user experience.

For instance, in a console made for customer service agents, users would prefer a feature such as knowledge recommendations according to a given scenario. Making these features a part of the application can help application users to perform complaint resolution more effectively.

Salesforce offers all these features in services such as Salesforce Einstein. Enterprises can leverage intelligent solutions that help them obtain maximum efficiency and productivity.

Furthermore, the user experience has to be seamless and accessible every time the user interacts with the application. All customers and employees want to interact with companies using their preferred channels. The reason behind this is that they have to complete transactions over multiple devices.

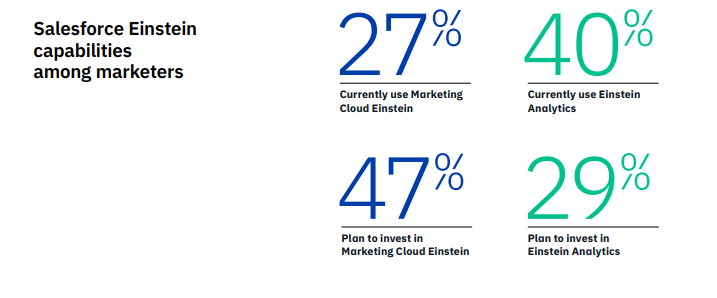

(Salesforce Einstein has the ability to benefit marketers in various ways; a considerable portion of Salesforce users either use Marketing Cloud Einstein, Einstein analytics or both. [Image Source])

Salesforce has invested in services such as Einstein Voice to provide its customers with a reliable AI-powered voice assistant. The Bots installed in the application along with virtual assistant allows Salesforce to expand touchpoints beyond traditional channels.

Empowering Trailblazers and Partners

Salesforce continuously supports ISVs with the help of monetized AppExchange programs. These programs are open for everyone including startups, partners, and incubators. The company’s strategic investment in training and education Trailhead has helped it to grow a community of developers to its side and accelerate the adoption of its solutions.

Salesforce has used the Lightning Platform to empower all Trailblazers. Trailblazers are professionals that pioneer new solutions for their respective communities with the help of Salesforce solutions.

Trailblazers serve as a means to promote and implement key services for Salesforce. Salesforce helps these professionals and leaders to build apps and solutions with the help of LCAP and deliver business value easier and faster.

The company also assists Trailblazers to learn in-demand skills and interact with the growing community of developers that are also a part of the Lightning LCAP Platform. At the same time, the Lighting Platform facilitates professionals by providing them with the governance necessary to implement IT standards and procedures in low-code environments.

As a result, professionals can make most of the innovations in training and testing environments. They can use these environments to help professionals collaborate with IT teams and construct new features while following all necessary procedures for data and application security.

The time and effort Salesforce has invested in making Salesforce solutions more acceptable and easy to deploy has played an essential role in its success.

Growth of Salesforce in Fiscal Year 2020

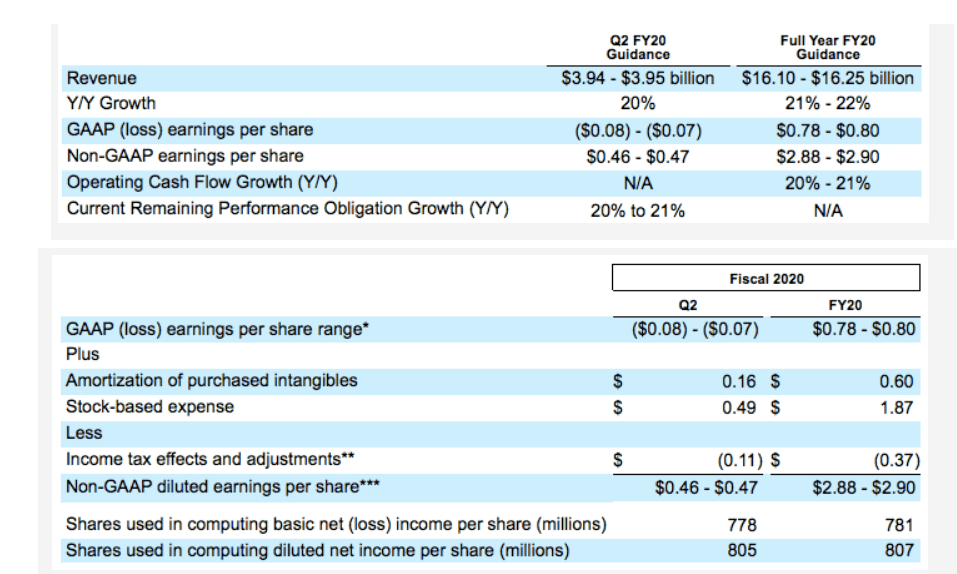

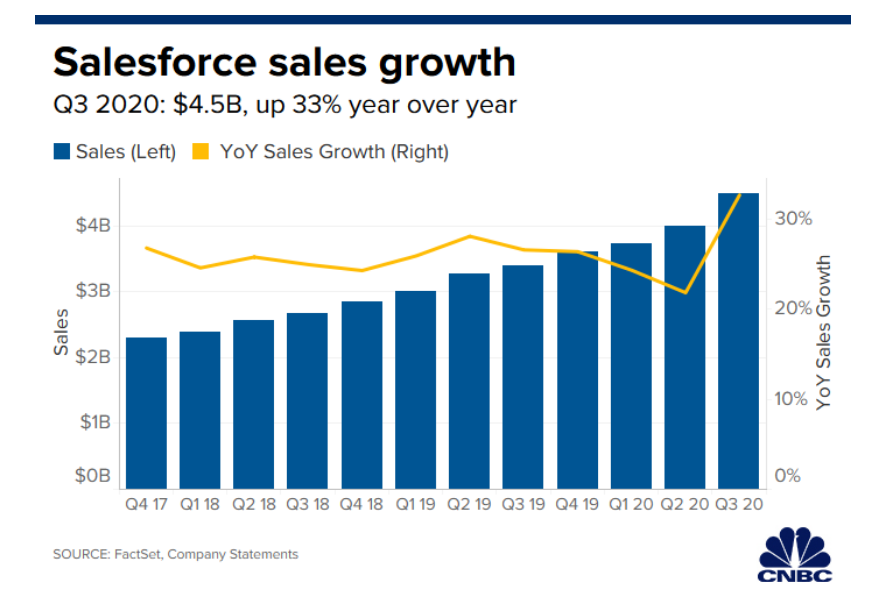

Salesforce has had an outstanding year in 2019 revenue and has managed to accomplish all its targets. The company started its year by achieving first quarter revenue of $3.74 billion. The increase was measured at a 24% increase over the year and leveled at 26% in constant currency was taken into account.

(Salesforce Non-GAAP and GAAP figures for Q1 FY2020 taken from the company’s Press Release. [Image Source])

Salesforce had accumulated an operating cash flow of $1.97 billion, which was 34% more over the year. The company had set the second-quarter revenue guidance in the range between $3.94 Billion and $3.95 Billion. Nevertheless, the company was able to surpass the forecasted range and began the second quarter with $4 billion in revenue.

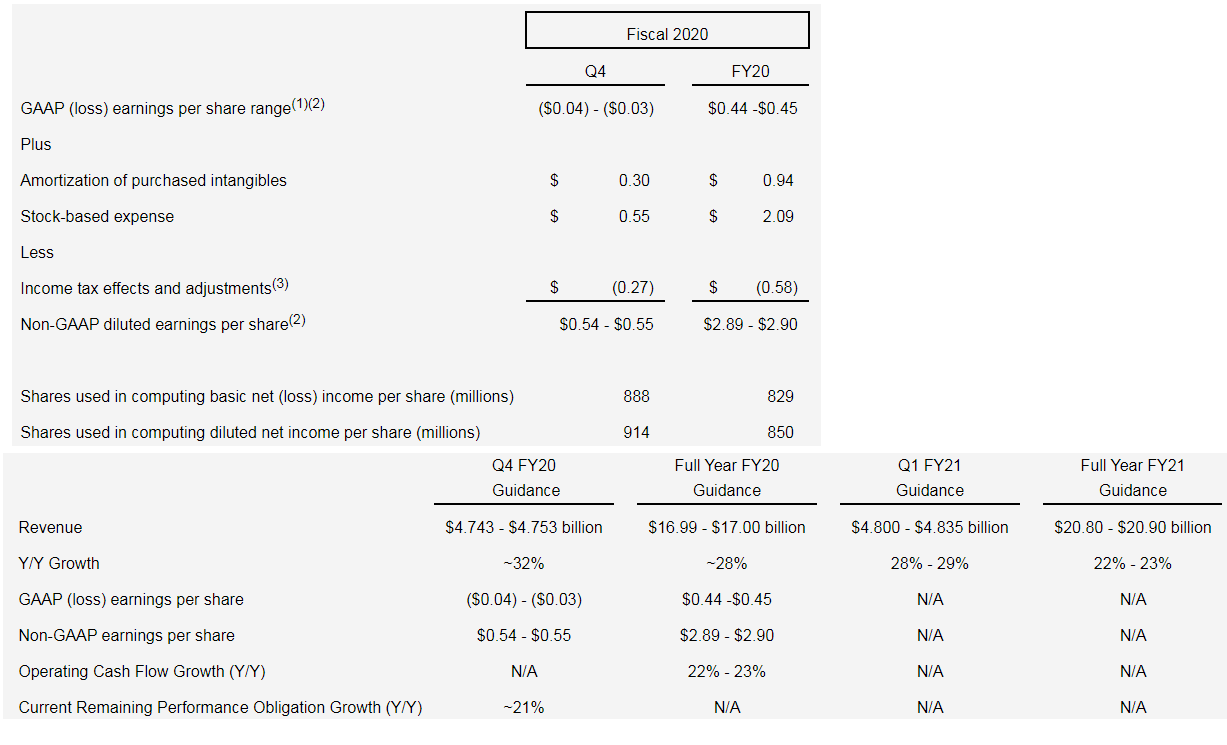

Following the second quarter, the Third Quarter Revenue Guidance was set at $4.44 billion to $4.45 billion. Nonetheless, Salesforce third quarter was more successful than expected and opened the third quarter with $4.5 billion in revenue.

The recent figures were able to churn a 33% Year-Over-Year growth rate, which translates into 34% in constant currency. Furthermore, the company was able to set the revenue guidance for the fourth quarter from $4.743 billion to $4.753 billion.

(A summary of the sales growth of Salesforce since Q4 2017 to Q3 2020 by CNBC. [Image Source])

At the end of Q3 FY2020, the company estimates revenues of $16.99 billion to $17 billion. The recent upward trend by the company has to lead the Chief Financial Officer, Mark Hawkins to suggest that the Salesforce has the potential to double in size by the year 2024. This means that Salesforce is aiming at total revenues of $34 billion to $35 billion at the end of 2024.

The biggest reason for the continuous increase in revenue has been Salesforce’s homegrown Sales Cloud business. The CRM cloud solutions account for 15% of the total revenue provided by the company, which amounts to $1.17 billion.

With that said, while the company lets its core business mature, it also looks for expansion through its high-profile acquisitions. Salesforce has invested a considerable portion of its earnings in the acquisition of Tableau ($15.7 billion), Mulesoft ($6.5 billion) and ClickSoftware ($1.35 billion). All these acquisitions open doors for further growth of Salesforce in 2020 and beyond.

(Salesforce Non-GAAP and GAAP figures for Q3 FY2020 taken from the company’s Press Release. [Image Source])

What Does the Future Hold for Salesforce

Despite Salesforce’s tremendous success in the growing enterprise solutions market, it’s important for the company to diversify its portfolio to continue its streak of success. However, the company has made considerable efforts to expand beyond its niche.

Since the launch of Lightning Experience in 2015, Salesforce has remained actively mobile in the CRM solutions market. With the help of this development, the company was able to offer an efficient of its core CRM product.

Users of Salesforce CRM tools could use the tool to increase the productivity of sales representatives and utilize features such as business analytics and intelligence. Due to the accessibility to low-code development environments in Salesforce products, it was easier for customers to develop customizable opportunity boards and dashboards.

These tools helped sales professionals get a wholesome view of all the deals they were making and identify and analyze key factors that affected their performance. At the same time, features such as contextual hovers, enables sales professionals to know critical information about the client without navigating through several pages.

The acquisition of Tableau carried out by Salesforce in 2019 is the follow up of other significant mergers and acquisitions in the business intelligence space. Before Salesforce,

Google had announced to buy Looker, business intelligence and analytics firm for $2.6 billion. The reason for this ambitious announcement is that Google wanted to embed features such as data visualization and analytics to Google’s Cloud platform.

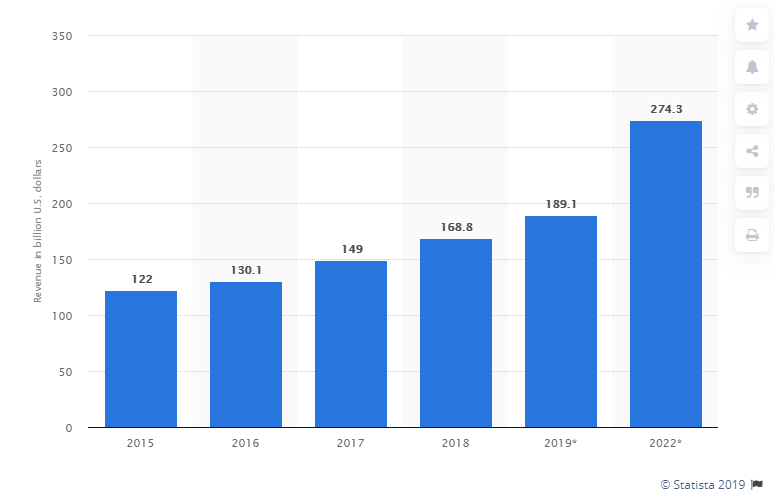

Companies are looking forward to capitalizing on the usefulness of data science and analytics capabilities by including them in their platforms. Statista suggests that the revenues for big data and business analytics features have the potential to generate $189.1 billion worldwide in 2019.

(The global business analytics and big data revenue can increase by more than 45%, by 2022. [Image Source])

If the trend continues, the big data and analytics industry can attain as much as $274.3 billion by the end of 2022. This makes BI and analytics one of the most high-growth areas in business technology. For this reason, companies that don’t already provide these services are looking to enhance their business intelligence offerings with the help of mergers and acquisitions.

With acquisitions such as Tableau, Salesforce can leverage big data and data science capabilities and integrate them into its Marketing Cloud and Service Cloud. These features can help the company implement automated customer service tasks through the Service Cloud.

At the same time, marketers using Salesforce enterprise solutions can leverage predictive and targeted marketing by incorporating data analytics in the Marketing Cloud. Nowadays, companies are starting to realize the benefits of leveraging data science. Therefore, investing in data-driven solutions is always going to be a step in the right direction.

Besides Tableau (renamed as Customer 360), the company has solutions such as the AI-powered Sales Cloud Einstein. The platform can deliver predictions, insights, and recommendations derived from a company’s customer data.

Companies can later use these insights to make informed decisions regarding their leads and sales. While companies leverage data-driven insights, the solutions will continue to learn from the CRM data of the company and analyze components such as whitespace, team performance and pipeline trends.

Salesforce is targeting to make advances in data analytics by automating data analytics. By using data analytics features, companies can save in terms of manpower, opportunity costs, and time.

The company is determined to provide further data analytics and business intelligence features in the future. The introduction of an intelligent voice assistant known as Einstein Voice is a testament to the company’s focus towards AI-enabled solutions.

The tool uses natural language processing (NLP) to understand voice commands of users. Therefore, users of this application can instruct Einstein AI to complete automated tasks such as updating Salesforce records and creating tasks for the sales team.

Currently, Salesforce is leading the CRM market; however, it continues to face rising competition from companies like Adobe, Microsoft, SAP, and other large enterprise solutions providers. If Salesforce continues to develop customized tools for CRM delivered to specific business categories and gives its users personalized experiences, it can maintain its steady growth in the coming years.