The IT industry and related sectors make up eight percent of the country’s overall GDP, making it a key part of India’s economy. This is revealed by Statista. Another important revelation made by Statista is that the IT industry generated approximately

US$ 180 billion in 2019. Most of this revenue was generated from exports, which included IT exports of $70 billion and software products and engineering services exports worth $28 billion. Following is an illustration of this:

(The infographics above show the contribution of exports to the overall revenue generated by the Indian software/IT industry in 2019. [Image Source])

From the above statistics and infographics, it is clear that the Indian software industry is a major part of the country’s economy and that it is contributing a lot to the global IT industry through IT, software, and engineering services exports.

According to economic times, the International Data Corporation has forecasted India’s IT and business service market to reach

$14.3 billion by 2020. Additionally, the IDC predicts the Indian IT services market to grow at a CAGR of 8.6% during the forecast period 2019-2023 to reach $14 billion by year-end 2023.

The India Brand Equity Foundation (IBEF) predicts that the Indian IT industry will achieve a revenue target of

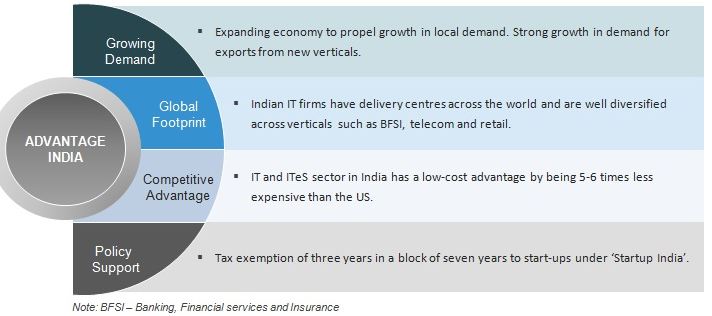

$350 billion by 2025. According to IBEF, the driving factors behind this growth in revenue will be a growing demand, a global footprint, competitive advantage, and policy support. Following is an infographic from IBEF that illustrates this better:

(Above is an infographic from IBEF that details the factors that provide the Indian IT Industry with a competitive advantage and that will push the revenue generate by the Industry to an estimated $350 billion by 2025 [Image Source])

The standing of the Indian

Software industry in the global IT market is continuously boosted by innovative developments in health, telemedicine, clinical information systems, and remote monitoring solutions that are either initiated or completed in India.

In addition to the above, the demand for IT products and services from India will continue to increase as companies making up the Indian IT/software industry become more advanced and increasingly standardize their processes, which is inevitable. However, there are some challenges for the Indian Software industry to overcome.

For instance, some policies have recently been introduced in the US and Europe that require IT companies to abide by stricter guidelines than before. A good number of IT companies based in India are finding it difficult to comply with the new requirements, which is negatively impacting their bottom line and the overall health of the Indian IT industry.

Growth of the Indian Software Industry: Pre-2000s to the Present Day

The Indian Software industry has grown tremendously in the past twenty years. Based on the development that took place during this time period, the growth of the Indian Software industry can be separated into three different eras or phases. Following is a detailed look at each of these eras.

1. The Pre-2000 Era

This is the era where the main focus of the Indian Software industry was to provide IT products and services to an International-clientele. In other words, it was a time when the majority of the IT companies and software houses in India viewed themselves as exporters of software.

However, these companies were forced to broaden their scope of work after the turn of the 21st century as they were repeatedly sought by companies that were facing Y2K issues. Ultimately, this resulted in the IT companies offering a greater range of services, which included the management of legacy applications and clients’ infrastructure.

In the latter part of the 1990s, we saw the creation of intercontinental internet infrastructure that came about as a result of the first wave of the global internet and dot-com era. By leveraging this infrastructure, software companies based in India were able to remotely deliver services related to software development to a global clientele.

Additionally, some multinational companies started to set up their own offshore development centers in India after becoming aware of the country’s IT potential and the availability of IT talent there. Moreover, enterprises that were involved in software aspects in hardware also started to look towards India to diversify their services portfolio.

2. 2000-2010

During the first half of the 2000s, many IT companies based in India became multinationals after setting up offices abroad. However, this did not happen overnight. Instead, it was calculated decision taken after spending years working on complex IT systems and with a wide range of international customers.

After becoming multinationals, the Indian IT companies started to offer a broad range of range. This included (but was not limited to) the following:

- Execution of complex and large projects that involved the integration of various IT services

- Complete end-to-end solutions that included IT infrastructure management, development of IT strategy, running services, and other similar solutions

While Indian IT companies started to set up their offices abroad, multinational companies based in different parts of the world started to look towards India to fulfill their need for IT products and services. Realizing India IT potential, these companies started to increase their presence and investment in India by setting up research and development (R&D), business process management (BPM), and information technology (IT) centers.

Currently, there are more than 1200 international technology companies with a presence or centers in India. Almost all sectors that contribute to the Indian economy have some presence of these companies. The sectors with the most international technology companies include the software industry followed by the telecom sector, the automotive industry, and the industrial sector. In the past few years, there has been a growth in these companies in other sectors. These sectors include healthcare, retail, and banking/financial services.

3. 2011 to Present

The Rise of the Unicorns

Several R& D centers were set up in India during the early part of the 2010s to aid the development of IT products and services for clients worldwide. These centers matured over the years and were finally able to deliver end-to-end products from India. Today, these centers are present in large numbers in the country.

In addition to delivering end-to-end products, these centers serve as the gateway to Asia. They assist different markets within Asia with product localization and the creation of new products. This has encouraged many globally recognized technology companies to set up their centers in India. Two examples of this are the engineering center of Uber that was set up in 2017 and the R&D center of OVH—a French-based unicorn that provides cloud services to customers worldwide.

These global research and development (R&D) centers in India employ more than four hundred thousand engineers. These centers are based in different parts of India, including in Chennai, Hyderabad, Pune, Bangalore, and the National Capital Region comprising of Noida, Delhi, and Gurgaon. This has resulted in the ecosystem of innovation, partnership, learning, and relearning that is spread across India.

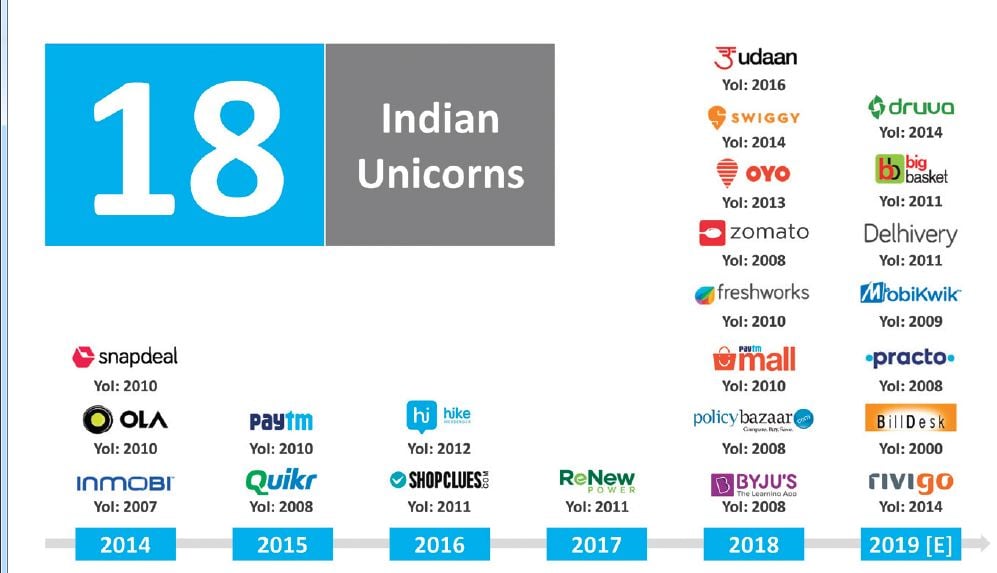

(Above is an infographic showing the top Indian unicorns to have surfaced since the start of the 2010s [Image Source])

From the above infographic, we discover the top 18 Indian unicorns to have surfaced since the start of the 2010s. The first unicorn to surface was Snapdeal in 2014. Snapdeal is an ecommerce company based in New Delhi, India. In 2017, Snapdeal was valued at

$2.5 billion.

Two other Indian unicorns surfaced in 2014. They were OLA and Inmobi. OLA is an Indian Transportation network company that provides services such as P2P ride-sharing, taxi and food delivery, and ride-hailing services. In Jan 2019, OLA was valued at

$5.7 billion.

Inmobi provides enterprises worldwide with platforms for mobile marketing and advertising. The company was recently valued at $1.2 billion.

In 2015, two more Indian Unicorns came to the fore. They included Paytm and Quikr. Paytm is a fintech company that offers innovative payment solutions to businesses and individual consumers in India. In May 2019, Paytm was valued at

$18 billion.

An online classified advertising platform, Quikr allows people and businesses across India to find buyers and sellers in a range of product/service categories. In October 2019, Quikr was valued at

$1.5 billion.

Come 2016, and two more Indian unicorns surfaced. These unicorns included Hike and Shopclues. Hike is a startup committed to building a new social future that wants to ensure the development of social products around people rather than the other way around. This struck a chord with many people. As a result, the company is now valued at

$1.4 billion.

Shopclues is an online marketplace that offers clothing, computers, home appliances, home décor, and a range of other products to online shoppers. The convenience offered by the online platform has helped it to become increasingly popular amongst people who like to shop from the comfort of their homes or on the go. As a result of this, the company is currently valued at

$1.1 billion.

Unlike the previous year, 2017 saw the emergence of only one unicorn, ReNew. It is the largest Independent Power Producer (IPP) in India that meets the energy generation needs of its clients via solar and wind-powered assets. In May 2019, the company was valued at

$2 billion.

After a quiet 2017, a flurry of Indian unicorns emerged in 2018. In total, there were 8 Indian unicorns that came to the fore during the year. These unicorns included Udaan, Swiggy, OYO, Zomato, Freshworks, Paytm Mall, Policy Bazaar, and BYJU’s.

Udaan is a B2B trade platform that specifically caters to small, mid-sized businesses in India. This has been a major reason for its success. In October 2019, the company was valued at approximately

$2.8 billion.

Swiggy is an online food ordering and delivery platform that is being touted as the largest and most valuable company in India in its category. As of March 2019, the company was operating out of a hundred cities in India. In December 2018, the company was valued at

$3.3 billion.

Also known as OYO homes and hotels, OYO allows travelers to book budget hotels in more than 230 Indian cities using their computer, laptop, or mobile phone. In July 2019, OYO was valued at

$10 billion after the company’s founder purchased shares worth $2 billion.

Zomato is an Indian food delivery startup and restaurant aggregator that offers food delivery options and provides menus, user reviews, and other information about restaurants. In March 2019, The Hongkong and Shanghai Banking Corporation (HSBC) valued Zomato at about

$3.6 billion.

A provider of automation tools and customer service software for businesses, Freshworks provides solutions for businesses of all sizes. This has helped the company to reach a valuation of

$1.5 billion. Paytm Mall is an e-commerce platform that offers a range of products, including mobile phones, shoes, clothing, bags, home décor, electronics, and more. It is a subsidiary of One97 communications and considered to be India’s largest online mall. In 2018, Paytm was valued at

$2 billion.

Policy Bazaar allows shoppers to compare the insurance policies offered by different insurance companies in India. This global financial technology startup also allows them to buy the preferred insurance policy online. Despite raising only $366 million to date, Policy Bazaar is considered to be a unicorn. This is because further investments in the business are expected soon.

The final Indian unicorn to have emerged since the start of the 2010s is BYJU’s. BYJU is an educational technology and online tutoring firm based in Bangalore. It provides students across the globe with a learning app.

Today, it has more than 16 million students registered on its platform. As a result of this, BYJU’s is considered to be the largest learning app for students in the world. In March 2019, the company was valued at

$5.4 billion. With this, we sum up the discussion on the 18 Indian unicorns that have emerged since the start of the 2010s.

A Vibrant and Multi-Dimensional Sector Driven by Innovation

An extremely vibrant and diverse sector, the current Indian IT industry is responsible for building and managing the most complex software and IT systems for clients worldwide. This has been possible due to the rapid growth of the startup ecosystem in India in the last few years.

Several factors have contributed to this accelerated growth, including less brain drain to the US and other western countries, greater availability of IT talent, an increase in the number of R&D centers that belong to both local and international technology companies, and a large presence of global venture capitalists. Overall, there are more than seven thousand startups in India, the majority of which were launched in the last five years. In fact, over a thousand of these startups came to the fore within the last year.

In India, there are primarily two types of technology startups. Focused mainly on the Indian market, the first type of technology startups in India is consumer-led. Initially, these companies mimicked whatever their counterparts in the US were doing. However, they have matured over the years and now offer unique innovations that cater specifically to the Indian Market. An example of this is the cash-on-delivery model that was first introduced in India and is now used by consumers worldwide. The focus of the second type of technology startups in India is to serve global markets such as the US and European markets.

In recent years, many startups in India have reached a valuation of the $1 billion or more. Some of these companies have been discussed above. One unicorn that we did not discuss was Flipkart. It is an e-commerce business based in Bengaluru that was bought by Walmart in 2018 at a valuation of

$16 billion.

Another startup that started from scratch but is now a booming technology-based company is OYO. Started by twenty-year-old, OYO is a technology franchise model hotel chain that has grown from an idea to a platform with the largest number of rooms in India. That is how big the company has grown in the space of five years.

Overall, innovation in the Indian Software/IT industry is being driven at an accelerated pace by startups, some of which are now unicorns. In addition to encouraging a culture of innovation and creative thing in their organizations, the startups are building partnerships with larger companies to continue innovating at a rapid pace and provide both the local-global clientele with the talent, IT products and services, and intellectual property that they desire and are looking for.

Growth of Startups, GICs, and Revenue in the Indian IT Sector

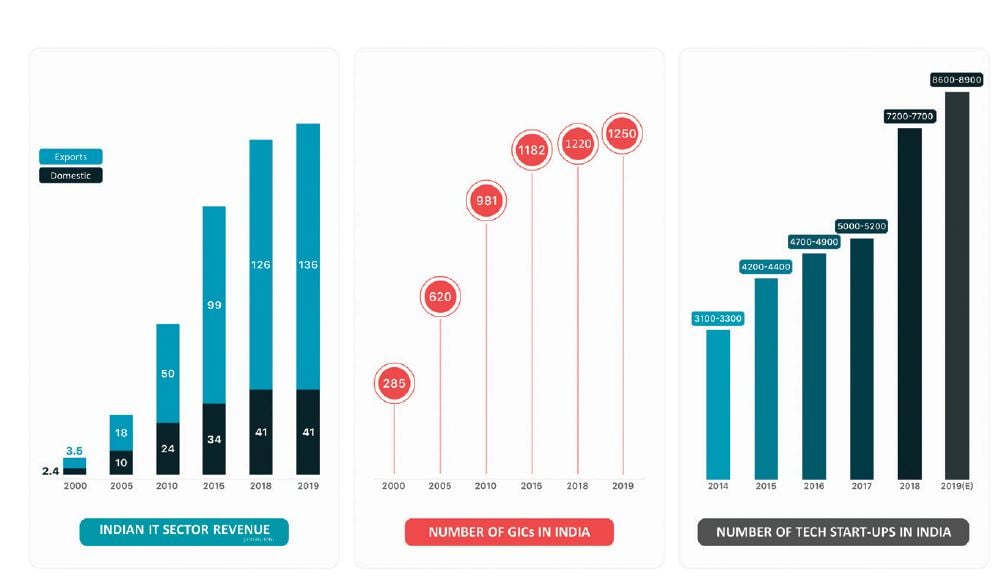

(Above are bar charts showing how the Indian IT/Software Industry has progressed from 2000 to 2019 in terms of revenue growth and number of tech startups in the country [Image Source])

The Growth of Revenue in the Indian IT Sector

From the above graphs, we find that the total revenue generated by the Indian IT sector in the year 2000 was $5.9 billion. $2.4 billion of this amount was generated domestically while exports contributed $3.5 billion to the overall revenue. This trend continued in 2005, where revenue generation from the domestic market was $10 billion compared to $18 billion in IT exports.

Five years later, in 2010, the overall revenue generated by the Indian IT industry increased to $74 billion, with $24 billion being domestic revenue generation and $50 billion coming from exports. In 2015, the total revenue increased to $133 billion. $99 billion of this amount or revenue came from exports, while $34 billion were generated domestically.

The total revenue generated by the Indian IT industry increased to $167 billion in 2018. $41billion was generated from the sales of IT products and services in the domestic market, and $126 billion were generated from exports. In 2019, the total revenue generated by the Indian IT sector jumped to $177 billion. Of this amount, $136 billion came from exports, while $41 billion were generated domestically.

The Growth of GICs in India

The world’s topmost destination for offshoring engineering in the last ten years, India comprises of just under 50% of the world’s top 500 R&D spenders and 46 of the top ER&D spenders. Many of these R&D and ER&D centers are global in-house centers (GICs).

First launched as ‘captives’ in the 1990s. GICs are offshore centers that execute specific functions for large enterprises. Over the last two decades, the GIC landscape has evolved significantly. During this period, GICs in India have transitioned from ‘cost savers’ to ‘enablers of growth’ to global leaders for their home corporation.

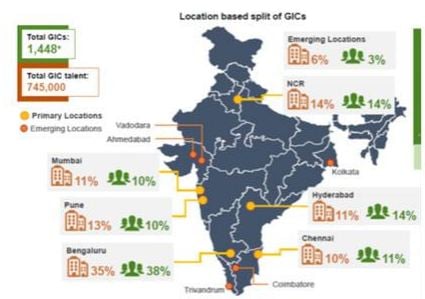

Today, the focus on Indian GICs is on high-value activities such as establishing COEs, creating competencies around emerging technologies, IP-creation, and taking complete charge of vendor management. Currently, there are over 1,200 GICs in India. These GICs are spread across the country. The following illustration provides more insight into this:

(The above infographic shows the locations in India with the greatest number of GICs [Image Source])

From the above infographic, we find that the majority of the GICs in India are present in Bengaluru. Pune comes in second place, followed by the National Capital Region (NCR), Mumbai, Hyderabad, and Chennai. 6% of the GICS are present in other parts of India, which are categorized as emerging locations.

The GICs in India that are spread across the country employ more than

800,000 people and generate total revenue of over $20 billion. This growth of GICs in India has been possible due to their ability to lower/save costs for an enterprise. However, the digital disruption that has transformed industries worldwide is now changing the role of GICs in India.

In addition to cost savings, GICs in India will have to focus on the following areas to stay relevant in the future:

- Leadership quality

- Analytics

- Domain expertise

- Traditional IT

- Digital IT

While most leaders in GICs are already focused on these priorities, they are not prioritizing traditional IT as much as Global Chief Experience Officers (CXOs) would want them to. While it is important for GICs to excel at IT capabilities of the digital age, they mustn’t ignore the cost reduction of traditional IT for this; doing this will hurt the fund growth initiatives of the CXOs. The GICs must also look to upgrade traditional IT for digital initiatives.

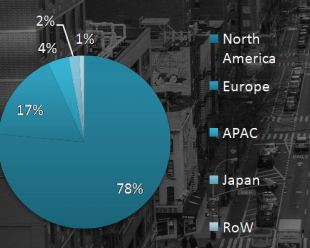

While there are over 1200 GICs or captives in India, there is a very small percentage of the total GICs in the world. In fact, India’s share of GICs comes under the rest of the world (RoW) category, which accounts for only 1% of the overall GIC share. Following is an illustration of this:

(Above is a pie-chart showing the percentage of captives/GICs by location [Image Source])

From the above infographic, we find that North America has the greatest share of the total GICs worldwide. It is followed by Europe that has a 17% share. Next comes APAC, followed by Japan and then the rest of the world. India comes under the rest of the world or the RoW category.

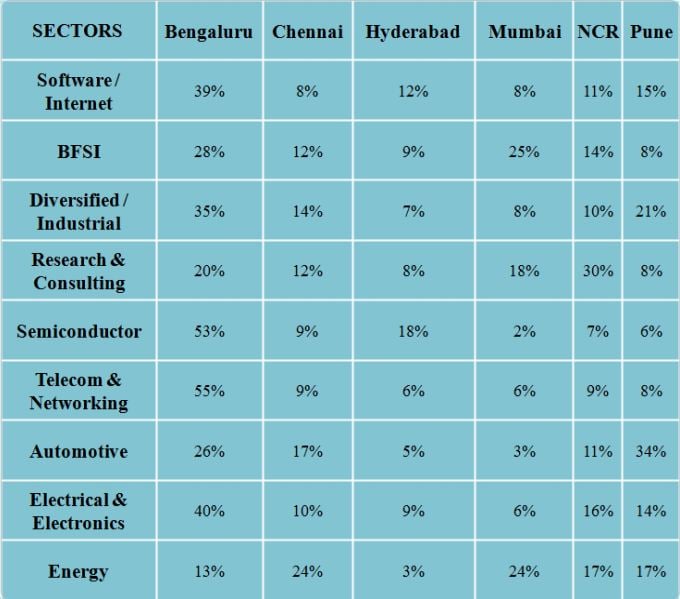

We already know which locations in India have the majority of the GICs in the country. However, what we still need to find out is which sectors of the Indian or global economy are these GICs catering to. The following table provides the answers:

(Above is a table showing the split of GICs in India in the different locations according to sector [Image Source])

From the above table, we find that the majority of the GICs in Bengaluru, which has over 35% of the total GICs in India, is in the Telecom & Networking sector. The greatest number of GICs in Chennai are in the energy sector. The most GICs in Hyderabad are in the semiconductor sector, in BFSI in Mumbai, in Research & Consulting in NCR, and in Automotive in Pune.

If we talk about sectors that are directly related to the software industry, then these would include the software/internet sector, Research & Consulting, BFSI, Telecom & Networking, and Electrical & Electronics sectors. From the above table, we find that all these sectors in all Indian locations with GICs have a sizeable presence of these centers.

If we talk about the IT GICs in India, then we find that the majority of the IT GIC exports in India are contributed by the BFSI sector. Following is an infographic showing the contribution to IT GIC exports by the different sectors and the companies in these sectors that were the largest contributors:

(Above is an infographic showing the contribution to IT GIC exports by the different sectors and the companies in these sectors that were the largest contributors [Image Source])

From the above infographic, we find that the BFSI sectors contribute 41% of the total GIC exports in India. The Telecom & Networking sector contributed 15% exports, 13% came from the Software & Internet sector, 9% from Diversified Industrial, 7% came from Automotive, 3% came from retail, and 12% from other sectors.

With the increase in the number of GICs in India, the demand for technical employees in the country is expected to increase by approximately

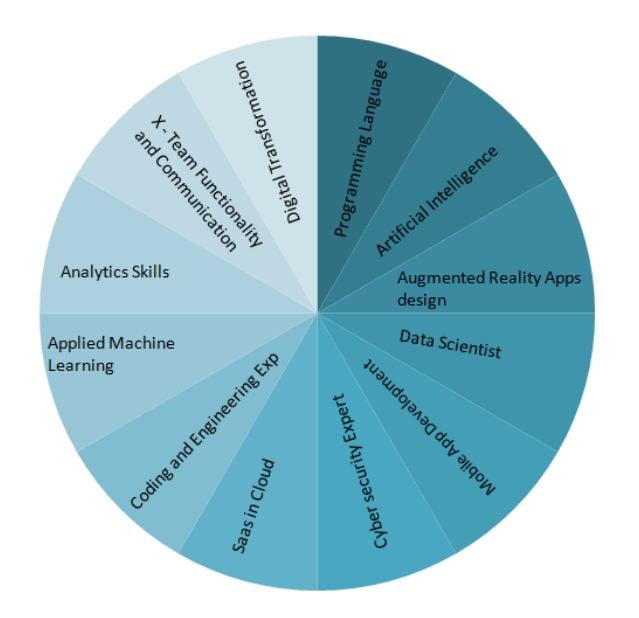

12% by 2024. In 2024, many job opportunities related to cybersecurity, analytics, applied machine learning, programming, coding, AI, mobile app development, augmented reality apps design, and more will emerge in India. Mobile app development and augmented reality apps design, in particular, will provide fresh graduates in India with many job opportunities.

Newly graduated app developers will have a chance to work with the

top app development companies in India. Here, they will be required to perform a variety of application development, including iPhone app development and android app development. This will help them to enhance their app development skills and ultimately venture into other tech-based fields that require top

software developers. Below is an illustration of the top skills to hire in 2020 and beyond.

(Above is an infographic depicting the top skills to hire in 2020 and beyond [Image Source])

Growth of Tech Startups in India

The number of tech startups in India has grown significantly in the last five years. In 2014, there were between 3100-3300 tech startups in India. This number grew to 8600-8900 in 2019, which shows an addition of 5000 tech startups within the space of just 5 years.

The number of tech startups in India has grown steadily over the years. In 2015, the number of tech startups in the country were 4200-4400. This number increased to 4700-4900 in 2016, 5000-5200 in 2017, 7200-700 in 2018, and finally 8600-8900 in 2019. The greatest increase in the number of tech startups in India occurred in 2018. This was the same year in which 8 of India’s top 18 unicorns came to the fore. This indicates that 2018 was the greatest year in the recent past for the tech startups in India as well as the overall Indian IT industry.

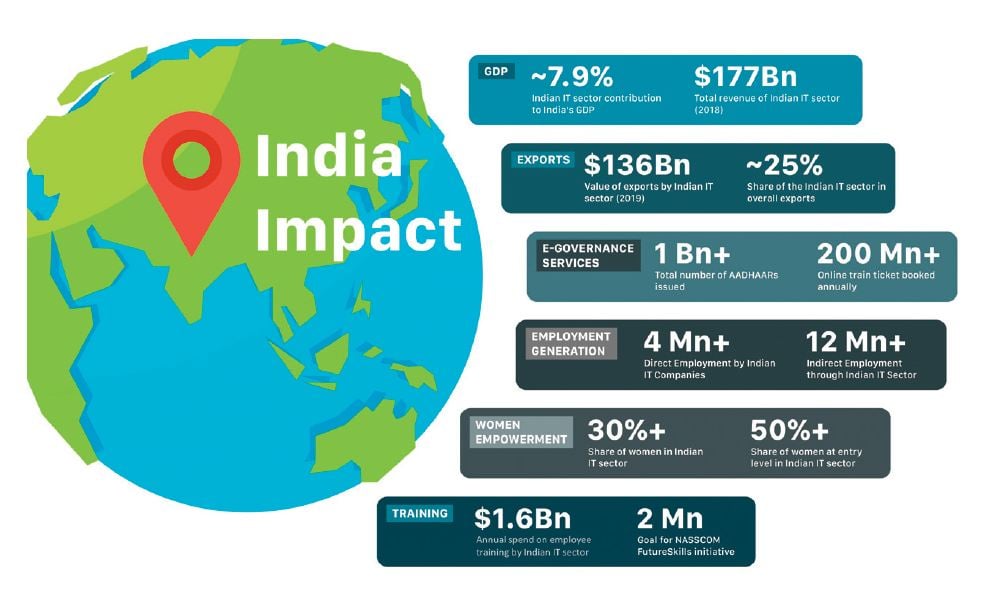

The Impact of the Indian Software Industry on the Overall Indian Economy

The impact of the IT/software industry on the overall Indian economy has been enormous. Not only is the Software/IT industry contributing significantly to the overall revenue growth of the country, but it also adds to the country’s digital infrastructure, talent capability, and diversity in the workforce. Below are all the contributions being made by the Software industry to India’s economy.

Growth in Exports

The IT industry is helping to transform India’s finances by increasing overall revenues and foreign exchange. Currently, the IT sector is the biggest earner of forex from exports in the country, accounting for more than a quarter of India’s total exports. The overall contribution of the sector to the country’s GDP is almost 8%.

Creation of Employment and Capability Development

The IT sector directly employs

3.9 million people in India. Employment opportunities in the sector are also growing, which is the reason we are witnessing so many people in India graduating out of engineering colleges every year. Additionally, there are specific processes in place at Indian companies to not only hire but also train and engage these engineering graduates.

To give you an idea of how many companies in India value the talent graduating out of engineering colleges, the companies in the Indian software/IT services sector spend

over a billion dollars on employee training each year. The training of many of these technology companies is focused on developing the skills of the new recruits to meet the demands of global customers.

As a result of this training, more than half a million of the Engineering/IT Talent in India already has the technical skills needed to drive digital transformation in the country. Additionally, the National Association of Software and Services Companies (NASSCOM) has started an initiative called FutureSkills, which aims to train about two million people in digital technologies over the next couple of years.

In addition to the above, other factors that are helping to enhance the digital capabilities of companies in India include the pool of talent already working in the software/IT industry and the extensive education system for engineering. More and more of the talent in IT companies are now shifting to enterprises in India to aid and accelerate their digital transformation.

Female Empowerment

Of the total IT workforce in India, 30% is made up of women, and this number is growing. Today, women are not only part of the Indian software/IT sector, but they are also playing a major role in the growth and expansion of the industry.

Startup Ecosystem

Between 2016 and 2018, the startups in India were able to attract total investments from venture capitalists worldwide that exceeded $10 billion. An example of this is the

$6 billion investment made in Indian startups by Softbank. Additionally, the number of tech startups in India that are categorized as unicorns are growing each year. This has been discussed in great detail earlier.

(Above is an infographic showing the impact of the Indian software/IT industry on the overall Indian economy [Image Source])

The Global Impact of the Indian Software/IT Industry

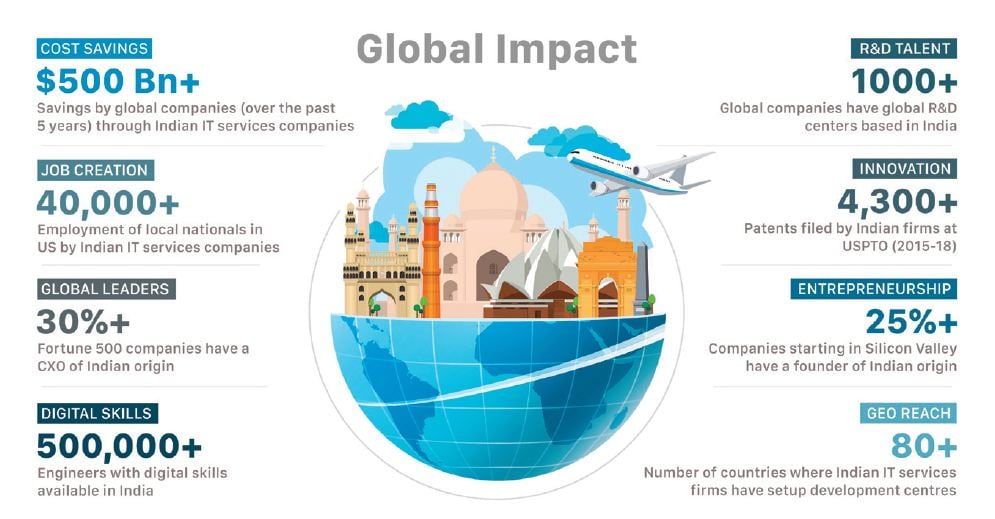

The global impact of the Indian software/IT industry is illustrated by the following infographic:

(Above is an infographic showing the global impact of the Indian software/IT industry [Image Source])

From the above infographic, we find that overall savings for companies worldwide by Indian IT services companies amount to over $500 billion. Another interesting finding is that more than forty thousand people in the US are employed by Indian IT services companies.

A matter of great pride for Indians worldwide is that over 30% of the CXOs of Fortune 500 companies are of Indian origin. India is also a major hub of talent with digital skills. There are over half a million engineers in the country with digital skills.

Another key finding and something that we have already touched upon is the presence of Research and Development (R&D) centers in India. There are over 1000 centers spread across the country. Indian is also one of the leaders in technology innovation.

Between 2015 and 2018, the total number of patents filed by Indian companies at the United States Patent and Trademark Office (USPTO) was over 4300. Indians are also making their presence felt in the global arena as entrepreneurs. Over 25% of the companies that started in Silicon Valley are founded by a person of Indian origin. Finally, there are more than eight countries where Indian IT services companies have established their development centers.

Key Statistics Related to the Indian Software Industry

We have discussed in detail the growth of the Indian Software industry, its contribution to the overall Indian economy, and its global impact. In this section, we will take a quick look at some of the important statistics related to the Indian Software industry that have not been covered yet.

The first statistic is that the packaged software spending in India is expected to reach

$5.3 billion in 2020. Another important statistic to note is that the infrastructure software market in India is now worth

$2.4 billion. Additionally, the Indian analytic applications software market is valued at

$31.6 million.

Another area of the India software/IT industry that has grown in the past few years is business intelligence software. Between 2012 and 2018, revenues from business intelligence software in India has grown by over

14%.

When it comes to IT services spending, the total spending on these services in India between 2014 and 2019 amounts to

$9.5 billion. Additionally, estimated revenues from public cloud services in India during the forecast period 2015-2020 are

$1.9 billion, and the largest segment of public cloud services is

Infrastructure as a Service (IaaS).

Another interesting finding is that application development and maintenance services revenues make up 38% of the total revenues of

Indian IT services companies. This is great news for all app developers and app development companies in India. It also emphasizes on the importance of businesses in India to invest in a mobile app development company or hire dedicated developers.

App developers in India are part of the over three and a half million people directly employed by the IT industry. The developers are part of the top app development companies in India that regularly contribute to both the Indian Software/IT industry and the country’s economy.

Conclusion

From the above, we find that the Indian Software industry has evolved and grown tremendously over the years. India is fast becoming the preferred destination for offshoring engineering/IT services. Not only is the Indian Software industry having an impact on the global IT industry, but it is also making a significant contribution to the Indian economy.

The global and local impact of the Indian Software industry is discussed in great detail in this guide. We have also discussed in this guide the growth of the Indian Software industry over the years, including the rise of the unicorns, and what makes the Indian IT industry a vibrant and multi-dimensional sector driven by innovation. Also discussed in this guide are the growth of startups, GICs, and revenue in the Indian Software/IT sector.

Our Review Process

Our writers spent more than 20 hours researching the Indian Software Industry, including its growth over the years, global impact, and contribution to the local economy. To come up with the information and statistics presented above, they read through the research of top sites. This research process makes the information provided by us trustworthy.